child tax credit 2022 tax return

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Web However if you opt for foreign tax credit instead of foreign earned income exclusion you can claim the Child Tax Credit refund.

2022 Tax Refund How Child Tax Credit Affects New York Parents Yorktown Ny Patch

Web Additionally the enhanced child tax credit allowed for a qualifying taxpayer could be refunded the difference between the amount of taxes they owed and the amount.

. Web The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a. They would receive another 3600 after filing their tax. Web Only available if you arent required to file a 2021 tax return usually earning less than 12500 single or 25000 married File for the Child Tax Credit EITC and the 2021.

The amount has recently been revised and the. Web Although the advance child tax credit payments are not taxable income you still want to report them on your taxes. For your 2022 tax return the potential return per dependent.

Web The remaining six months of the expanded Child Tax Credit will come as a single end-of-year tax credit to be claimed when filing taxes in 2022. Web The child tax credit CTC will return to at 2000 per child in 2022. Web The Child Tax Credit helps families with qualifying children get a tax break.

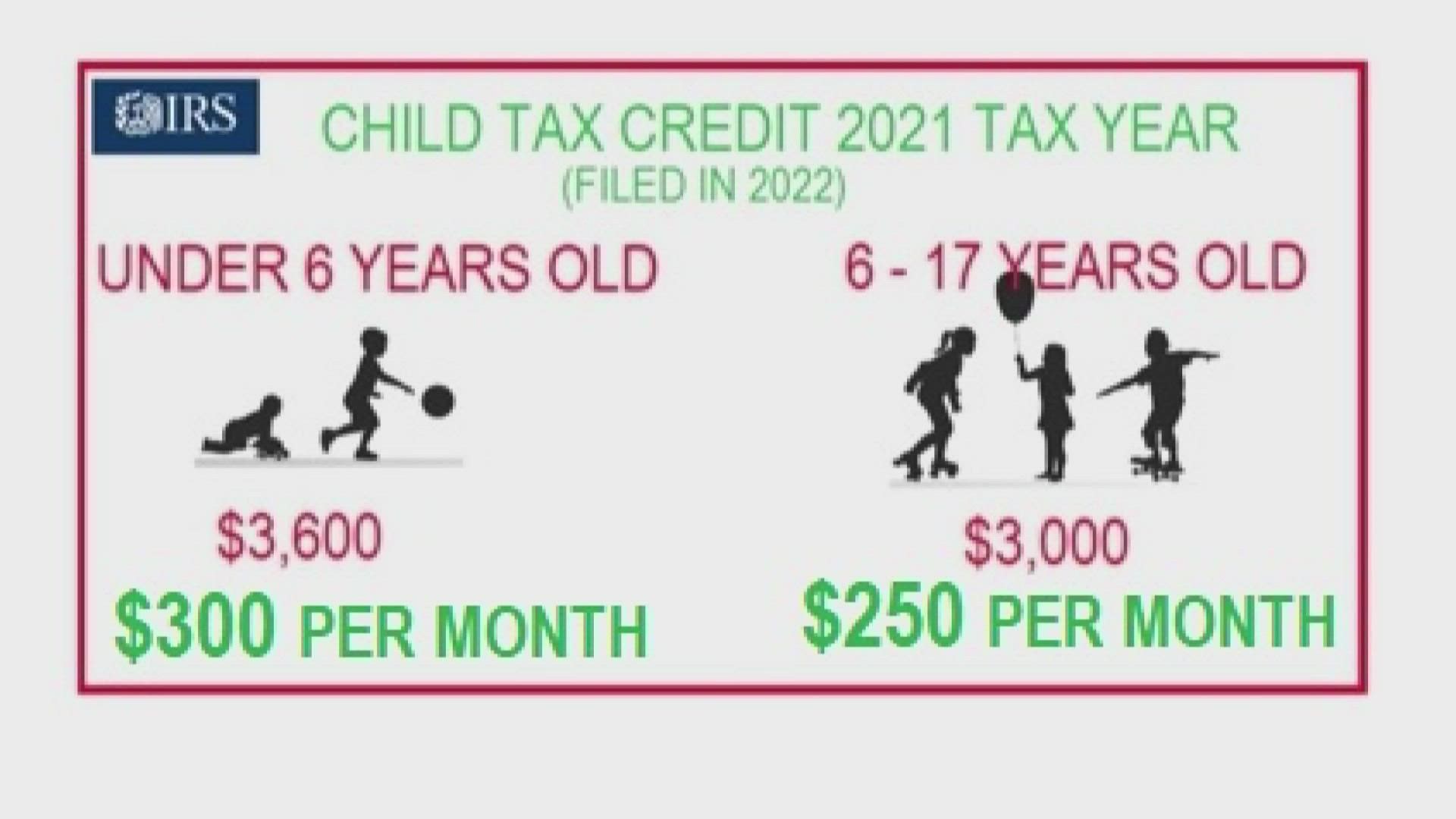

Web Over the second half of 2021 parents could receive advance payments of the years Child Tax Credit money claiming up to 300 a month for each child under the age. Web Last year the IRS increased the potential payout of the Child Tax Credit to 3600 per child up from 2000 the year prior. You may be able to claim the credit even if you dont normally file a tax return.

Web Enhanced child tax credit. Web There is no upper age limit for claiming the credit if taxpayers have earned income. Web They would be eligible to receive 3600 in six monthly installments of 600 between July and December 2021.

In 2022 the tax credit could be refundable up to 1500 a. Families must have at least 3000 in earned income to claim any portion of the credit and can. Web As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022.

Web Even if you have no earned income and have not yet filed a 2021 tax return you can still get a credit of up to 3600 if you claim it by Nov. Even if you received all six early payments you still. However Republican Senators Mitt Romney Richard Burr and.

Web The program sent monthly checks to eligible families in the latter half of 2021 with up to 300 per month for every child younger than 6 and 250 per month for older. Web The Child Tax Credit is worth 3600 for children ages 5 and under and 3000 for children ages 6 through 17 at the end of 2021. Claimed it on their 2021 tax return.

15 2022 according to the. The EITC is generally available to workers without qualifying children who are at. Web The American Rescue Plan allowed for an increase in the Child Tax Credit for the 2021 tax year.

Web SALISBURY Md- Key parts of the American Rescue Plan and the aid it gave to Americans are expiring this year which will mean big changes in the 2022 returns. Web If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit. 1200 sent in April 2020.

The tax filing period for this year. The advance payments are 50 of the. Web In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

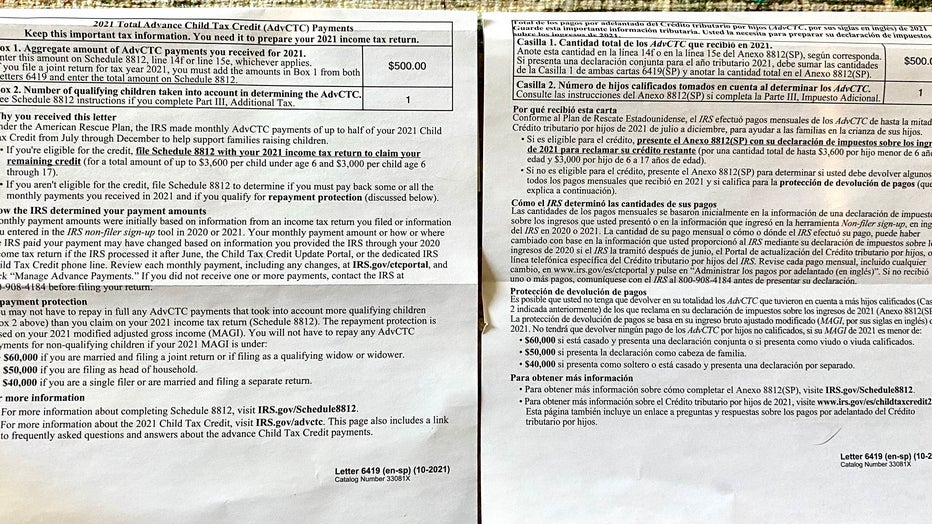

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Top 5 Things To Remember When Filing Income Tax Returns In 2022

Child Earned Income Tax Credits 02 16 2022 News Auburn Housing Authority Auburn Alabama

Child Tax Credit Shrinking 2022 Tax Refunds Komo

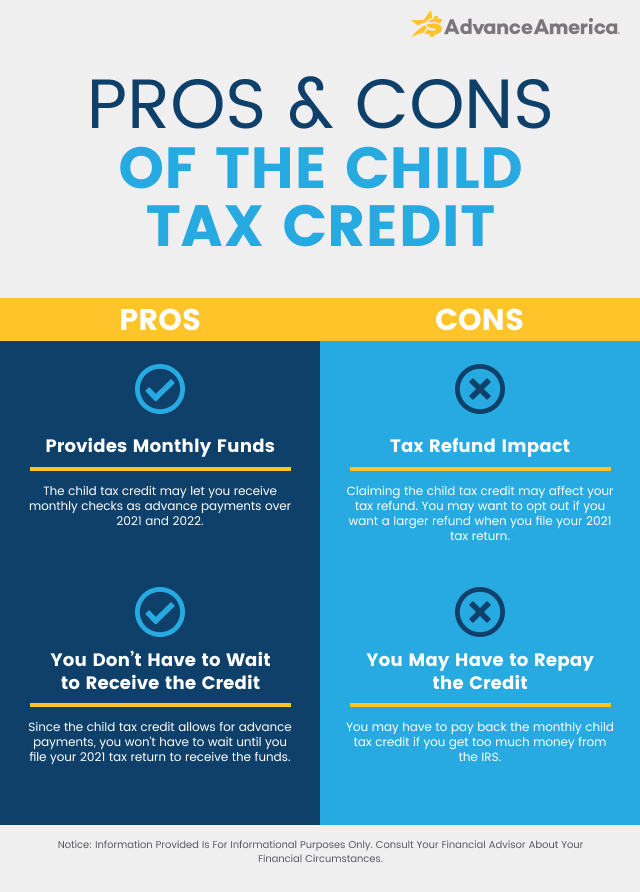

Will You Have To Repay The Advanced Child Tax Credit Payments Wdtn Com

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The New York Times

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Advance Child Tax Credit Filing Confusion Cleared Up

Child Tax Credit Payments Are Done How To Get Yours Wfmynews2 Com

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

Should I Opt Out Of The Child Tax Credit Advance America

2021 Child Tax Credit How Will It Affect My 2022 Tax Return As Usa

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit Bigger Tax Refund 2022 Youtube

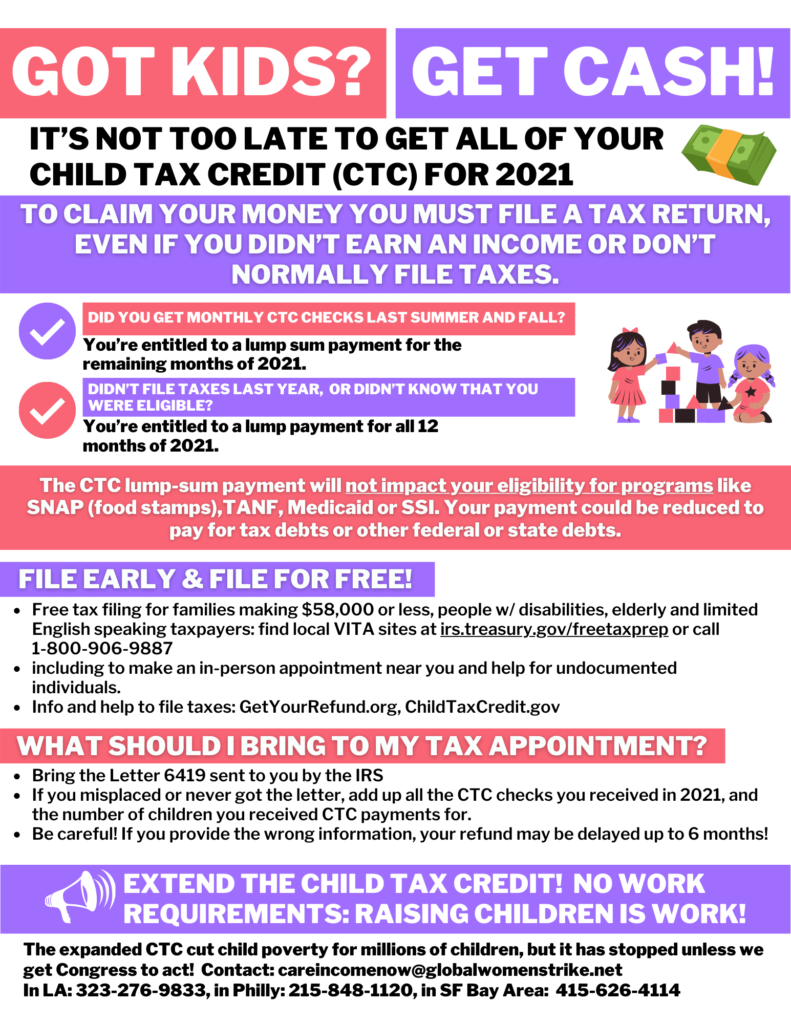

Take Action Child Tax Credit Earned Income Tax Credit Awareness Day Global Women S Strike Wages For Housework Selma James

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings